Corporate Tax Dodging: Unraveling the Myth of Job Creation

:

In today's complex and ever-shifting economic landscape, the issue of corporate tax dodging has taken center stage. Corporations, particularly multinational giants, have come under fire for their sophisticated maneuvers designed to minimize their tax liabilities while maximizing their profits. This article delves into the depths of corporate tax dodging, exposing the myth of job creation that has been peddled by corporations to justify their actions.

4.7 out of 5

| Language | : | English |

| File size | : | 882 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 312 pages |

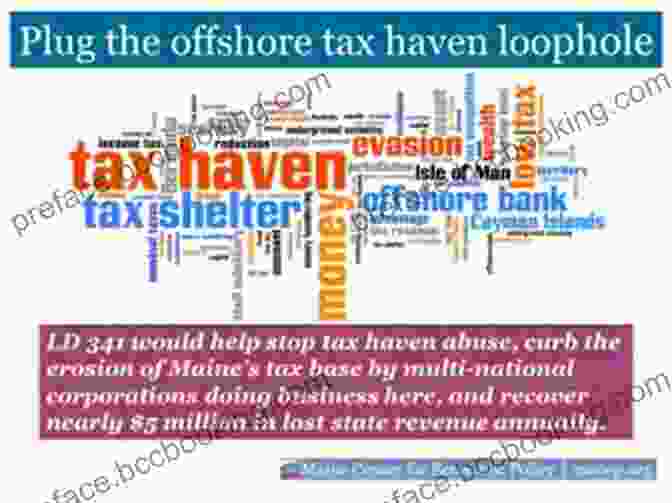

Chapter 1: The Corporate Tax Loophole Labyrinth

Corporations have mastered the art of exploiting legal loopholes and tax havens to avoid paying their fair share of taxes. These tactics often involve shifting profits to countries with lower tax rates, creating complex corporate structures, and engaging in transfer pricing schemes. The result is a systematic erosion of tax revenue that could have been invested in public services and infrastructure.

Chapter 2: The Myth of Job Creation

Corporations often argue that their tax avoidance strategies are necessary to create jobs and stimulate economic growth. However, empirical evidence has repeatedly debunked this claim. Studies have shown that tax cuts for corporations do not translate into increased investment or job creation. In fact, they often result in higher executive compensation and shareholder dividends.

Chapter 3: The Cost to Society

Corporate tax dodging has a significant cost to society. Lost tax revenue deprives governments of the resources needed to fund essential services such as education, healthcare, and infrastructure. This can lead to a decline in public well-being, increased inequality, and a diminished sense of civic responsibility.

Chapter 4: Reforming the System

To address the issue of corporate tax dodging, a comprehensive reform is essential. This includes closing loopholes, abolishing tax havens, and implementing stricter transfer pricing rules. Additionally, governments should explore progressive corporate tax structures that reward companies based on their investment in employees and environmental sustainability.

Chapter 5:

Corporate tax dodging is a global problem that undermines economic justice and erodes public trust. The myth of job creation propagated by corporations has been exposed, and it is time for a fundamental shift in how we approach corporate taxation. By implementing comprehensive reforms, we can ensure that corporations pay their fair share of taxes and contribute to the betterment of society as a whole.

4.7 out of 5

| Language | : | English |

| File size | : | 882 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 312 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Hans Staden

Hans Staden Lucy Simister

Lucy Simister Jeremiah J Brown

Jeremiah J Brown Grace Olmstead

Grace Olmstead Hannah Pilnick

Hannah Pilnick Hans Brinckmann

Hans Brinckmann Ronald W Doerfler

Ronald W Doerfler Halina Ogonowska Coates

Halina Ogonowska Coates Hal Vaughan

Hal Vaughan Grace Ellis

Grace Ellis Joyce Harper

Joyce Harper Grant Publishing

Grant Publishing Grace Mccready

Grace Mccready Gina Homolka

Gina Homolka Serena Valentino

Serena Valentino Gisle Solhaug

Gisle Solhaug L S Boos

L S Boos Hillary Hawkins

Hillary Hawkins Neejay Sherman

Neejay Sherman Guy Kawasaki

Guy Kawasaki

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Lucas ReedUnlock Your Acting Potential: A Comprehensive Guide to the Practical Handbook...

Lucas ReedUnlock Your Acting Potential: A Comprehensive Guide to the Practical Handbook... Dean ButlerFollow ·17.3k

Dean ButlerFollow ·17.3k John ParkerFollow ·15.6k

John ParkerFollow ·15.6k James JoyceFollow ·2.7k

James JoyceFollow ·2.7k Bill GrantFollow ·3.8k

Bill GrantFollow ·3.8k Austin FordFollow ·11.2k

Austin FordFollow ·11.2k Joshua ReedFollow ·6.9k

Joshua ReedFollow ·6.9k Bradley DixonFollow ·17.2k

Bradley DixonFollow ·17.2k George Bernard ShawFollow ·14.3k

George Bernard ShawFollow ·14.3k

Brady Mitchell

Brady MitchellMaster IELTS Speaking: The Ultimate Guide to Success

Kickstart Your IELTS...

Branden Simmons

Branden SimmonsBack Spin: A Thrilling Myron Bolitar Novel

Get ready to embark on a...

Marc Foster

Marc FosterData Structures and Algorithms: A Comprehensive Guide to...

In the ever-evolving...

Jeff Foster

Jeff FosterUnveiling the Basics of Microbiology: A Comprehensive...

The world of...

J.D. Salinger

J.D. SalingerHold Tight Suspense Thriller: A Gripping Page-Turner That...

Are you ready for a suspense thriller that...

4.7 out of 5

| Language | : | English |

| File size | : | 882 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 312 pages |